Oʻahu Market Update: January 2026 Snapshot

January kicked off 2026 with a market that feels steady-but-selective on Oʻahu. Single-family homes held relatively stable compared to last year, while condos softened a bit and took longer to move—giving buyers (especially condo buyers) a little more breathing room.

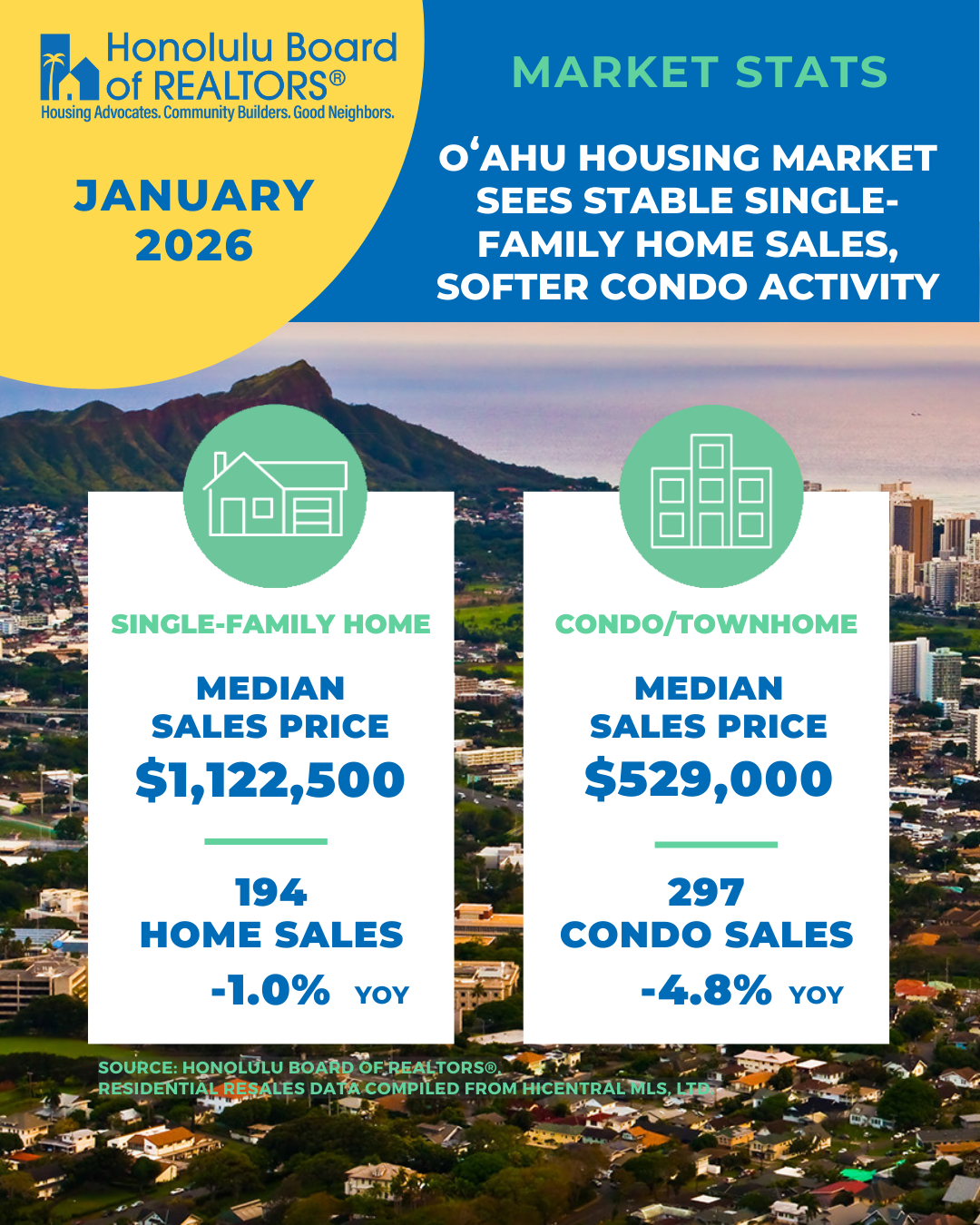

Below is a simple breakdown of what the Honolulu Board of REALTORS® reported for January 2026 (residential resales compiled from HiCentral MLS).

The quick headline

Single-family homes: sales were essentially flat year-over-year, and prices were steady.

Condos: sales and median price dipped slightly, and homes took longer to sell.

Pending sales rose in both markets, which can signal buyer activity is still there—just more value-focused.

Single-family homes (SFH): stable sales, competitive offers

Single-family home sales in January were 194, a 1.0% decrease from last year. The median sales price was $1,122,500, up 0.2% year-over-year.

Homes also moved at about the same pace as last January:

Median days on market: 27 days (vs. 25 days last year)

One of the biggest takeaways: competition increased.

About 31% of single-family homes sold above the original asking price (up from 23% last January)

Median percent of original list price received: 98.2%

What that means: If you’re shopping for a single-family home, the best homes can still get multiple offers—so strategy, timing, and clean financing matter.

Condos: more time on market + more negotiating room

The condo market recorded 297 closed sales, a 4.8% decrease year-over-year. The median condo price was $529,000, down 1.9% from last year.

Condos also took longer to sell:

Median days on market: 47 days (up from 39 days last year)

And condos were less likely to sell over asking:

7% of condo sales closed above asking price (down from 10% last January)

Median percent of original list price received: 96.0%

What that means: Condo buyers may have more leverage right now—especially for negotiating price, credits, or repairs.

Inventory: fewer single-family options, more condo choices

Inventory helps explain why the two markets feel different.

Active single-family inventory: 674 listings (-8.2% YoY)

Active condo inventory: 2,210 listings (+5.8% YoY)

What that means: With fewer single-family homes available, buyers often feel more pressure. With more condos available, buyers can be pickier.

Pending sales: the “watch this” indicator

Pending sales increased in both markets to start the year:

Single-family pending sales: 239 (+14.4% YoY)

Condo pending sales: 375 (+5.0% YoY)

What that means: Even with higher rates and cautious headlines, buyers are still writing offers. The market isn’t “stopping”—it’s shifting toward value and negotiation.

A note on the $500,000-and-below range

Homes priced at $500,000 and below accounted for 146 year-to-date sales in January, with more than 1,000 active listings available in that price range.

What that means: If you’re a first-time buyer or trying to stay under a certain payment, there is inventory to look at—but the right plan (loan options, HOA review, location trade-offs) matters.

3 takeaways (simple + practical)

Condo buyers: you may have more negotiating power than last year.

Single-family buyers: be ready to move quickly on well-priced homes.

Sellers: pricing and presentation matter—buyers are watching value closely.

If you’re searching for the latest Oʻahu real estate market update, Honolulu housing market stats, or what’s happening with Waikīkī condos and Kaimukī homes, I can help.

I’m Mai Kashihara (eXp Realty), a local Oʻahu Realtor, and I share clear monthly breakdowns of median home prices, days on market, inventory, and pending sales so buyers and sellers can make smart decisions. Want a quick answer for your situation—like “Is it a good time to buy a condo in Honolulu?” or “How much is my home worth on Oʻahu right now?”

Book a consult here: https://calendar.app.google/t6rYohGho6b7d5mbA