Rates Hit 5.85%. Why This Could Be Your Window Before the Rush

Aloha Mai Homes ʻohana,

quick market pulse for this week.

One of the biggest shifts I’ve been watching is that mortgage rates have been trending down — and today we hit a milestone.

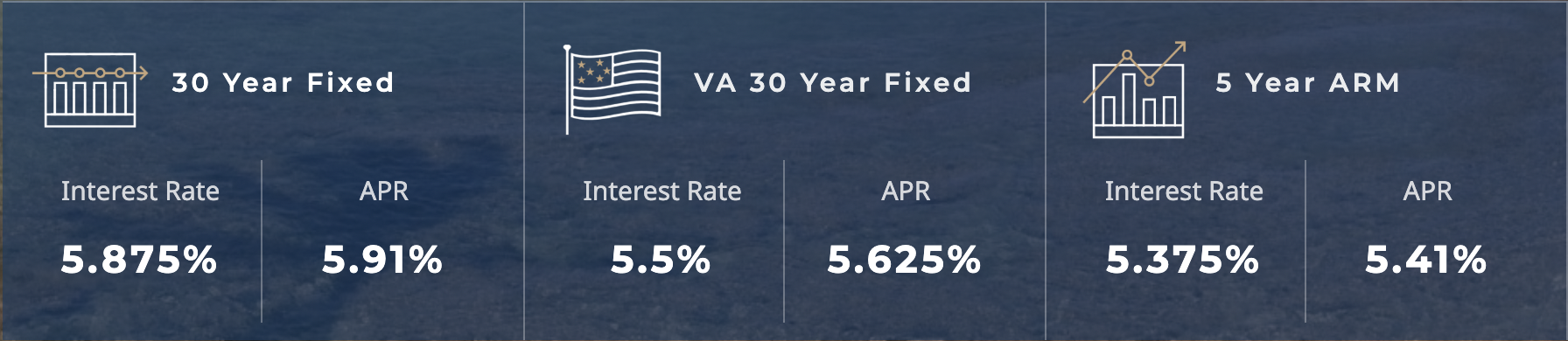

According to C2 Hawaii, today’s 30-year conventional is 5.85%.

Rate note from C2 Hawaii: Above rates are quoted NO POINTS (except ARMs), based on 780 credit score, purchase loan, loan amount < $1,249,126 (except JUMBO), and 20% down (except for VA & JUMBO).

This has been a slow and steady decline, but not everyone has recognized it yet — so the market still feels a little stale, and the holiday season also put a temporary halt on activity.

That’s exactly why I’m saying it: this can be a really good time to buy before the rush comes in.

What changed (and why it matters)

When rates come down, even gradually, it affects two big things:

Monthly payment (what most buyers feel the most)

Buyer confidence (what drives more showings + offers)

On Oahu, a small shift can change the vibe quickly — especially in areas where good inventory is always competitive.

What this means for buyers right now

If you’re thinking about buying (or you paused your search), here’s the opportunity:

1) You may have more buying power than you did a few months ago

Even if you’re not trying to “max out,” a lower rate can mean:

A more comfortable monthly payment

More flexibility to choose the home you actually want (layout, parking, location)

Less pressure to compromise as much

This matters a lot for condos, where HOA fees are a big part of the monthly — especially in Waikiki.

2) The market is still a bit stale — and that can be your advantage

Right now, we’re in that quieter window where:

Some buyers haven’t re-entered yet

Some sellers are still testing the market

Negotiations can feel a little more reasonable than peak “rush” season

If you’ve been waiting for a moment where you’re not competing with everyone at once, this is often it.

3) You can get ahead of the next wave

When more people realize rates are down, we typically see:

More showings

More offers (especially on move-in-ready homes)

Less room to negotiate on the best listings

So if you’re serious about buying in 2026, getting prepped now (before the crowd catches up) can be the difference between “we got it” and “we missed it.”

Waikiki vs. Kaimuki: why micro-markets matter

Oahu isn’t one market — it’s a bunch of micro-markets.

A rate dip might affect:

A Waikiki condo buyer differently (because HOA, parking, and building rules can be the deciding factors)

A Kaimuki / town buyer differently (because inventory, lot size, and condition vary a lot street to street)

That’s why I always look at your plan through a neighborhood lens — not just headlines.

3 takeaways for this week

Rates hitting 5.85% is a meaningful milestone — and it’s happening quietly.

The market still feels a bit stale, which can create opportunity for prepared buyers.

Buying before the “rush” returns can mean more choice and less competition.

Want me to run the numbers for you? Let’s talk story.

If you want to know what a rate shift could mean for your monthly payment — or if you’re trying to decide between renting vs. buying — I’ll help you map out a clear plan.

Book a quick consult with me here: https://calendar.app.google/t6rYohGho6b7d5mbA

Curious what your home could sell for? Get a home value estimate here: https://maikashihara.exprealty.com/seller/valuation/

No pressure — just real talk, local perspective, and a clear next step.

Mahalo,

Mai Kashihara

Mai Homes | eXp Realty